Should you get an extra LEED point? The way to frame the question is of course, is it worth the effort, will you or others benefit from the incremental work? To use economics jargon – what’s the marginal value of LEED?

In our research, we have turned up an interesting paper that quantifies this. The paper only looks at the rental and occupancy premia. That is how much extra rent you will get for your LEED endeavours (or how much you will benefit from having your building vacant less of the time). There are lots of other benefits that Autocase will put a dollar value on for you: reduced absenteeism; O&M; energy and water costs; productivity improvements; cleaner air and water; reduced carbon emissions; and less urban heat island among others. The people, planet, and profit perspective of triple bottom line cost benefit analysis (TBL-CBA) from Autocase is comprehensive.

Triple Bottom Line Cost Benefit Analysis (TBL-CBA) adds the CBA-based monetary values of social and environmental impacts to financial results to rigorously measure the TBL in dollars.

But, this paper, rather than focusing on social or environmental benefits, looks at the financial benefit.

For those keeping track I have posted two previous posts on the rent and occupancy of LEED. The first was here and drew on two papers. The second was here and drew on a wider number of papers (not all published in peer-reviewed journals) and buildings. The latest paper covers even more buildings and uses a more rigorous methodology to ensure that the rent (and occupancy) benefits are teased out of other possible confounding effects.

Here is a quick review of where our research into the rental and occupancy benefits of LEED has taken us and the numbers from those other posts:

| LEED Rental Premium | Number of Studies/Buildings | Minimum | Wtd. Avg. / Avg. | Maximum |

| Version 1 | 3/17,000 | 2.9% | 17% | |

| Version 2 | 5/43,407 | 4.5% | 5.9% / 7.8% | 16.0% |

| Version 3 | 1/20,801 | 3.9% | 5.8% | 7.7% |

| LEED Occupancy Rate Benefit | Number of Studies/Buildings | Minimum | Wtd. Avg. / Avg. | Maximum |

| Version 1 | 1/7,308 | 10% | 18% | |

| Version 2 | 3/8,013 | -5.5% | -1.7% / 6.5% | 17.0% |

| Version 3 | 1/20,801 | -1.0% | 0.2% | 0.8% |

See below of a list of what is covered in these versions.

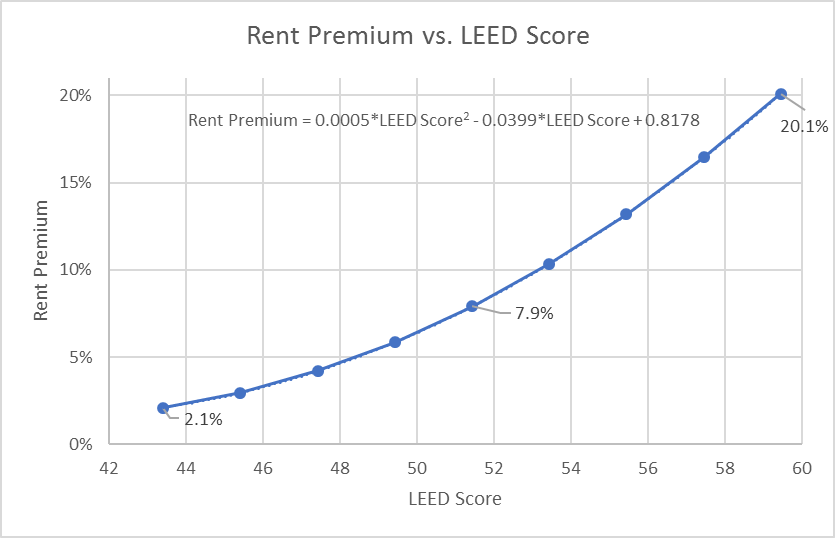

The latest paper we are looking at finds that LEED gets you higher rents and more LEED get you higher rents. Which prompted me to ask what is the value of an extra LEED point?

The paper gives us three points (and how to connect them):

“The relation between the rental increment and the LEED score is positive but nonlinear. From column 2, for example, it is estimated that a LEED-certified building with a normalized score of 40 (about 1 standard deviation below the average sustainability score of certified buildings) has an effective rent 2.1% higher than the rent of an otherwise identical registered building. A LEED-certified building with a normalized score of 60 (about 1 standard deviation above the average score of certified buildings) has an incremental rent almost ten times as large: 20.1%.”

Some perspective may be helpful. If your project has a LEED score of 51 (average for LEED certified buildings) and the going rent in the neighbourhood is $26/sq. ft., over a 30-year life rental premium is worth $1.8 million (for a 387,673 square foot average sized building – using net present value using a 10% real discount rate).

That’s $1.8 million for one extra LEED point.

So, what’s the cost of getting that extra point? Autocase for Buildings automates the process to achieve the new LEED pilot credit for triple bottom line analysis and you get 1 more point for doing it. Autocase for Buildings costs $249.

That’s a return on investment for Autocase of 750,878%.

Papers Reviewed & Summarized in the tables above:

Version 1:

- Reichardt, A., Fuerst, F., Rottke, N., & Zietz, J. (2012). Sustainable building certification and the rent premium: a panel data approach. Journal of Real Estate Research. – http://pages.jh.edu/jrer/papers/pdf/forth/accepted/sustainable%20building%20certification%20and%20the%20rent%20premium.pdf

- Fuerst, Franz, and Pat McAllister. “Eco-labeling in commercial office markets: Do LEED and Energy Star offices obtain multiple premiums?.” Ecological Economics 70.6 (2011): 1220-1230. – https://www.sciencedirect.com/science/article/abs/pii/S0921800911000565

Version 2:

- Spivey and Florance (2008) Published in Journal of Real Estate Portfolio Management

- Wiley, Benefield and Johnson (2010) Published in Journal of Real Estate Finance and Economics

- Eichholtz, Kok and Quigley (2010) To be published in American Economic Review

- Fuerst and McAllister (2011) Published in Real Estate Economics

- Chegut, Eichholtz, Kok and Quigley (2010) Draft working paper

- Dermissi (2009) Published in Journal of Sustainable Real Estate

- Fuerst and McAllister (2009) Published in Journal of Sustainable Real Estate

- Fisher and Pivo (2009) Draft working paper

- Deng, Li and Quigley (2011) Regional Science and Urban Economics forthcoming

- Shimizu (2010) Draft working paper

- Brounen and Kok (2011) Journal of Environmental Economics and Management

- Fuerst and McAllister (2010) Ecological Economics

- Eichholtz, Kok and Quigley (2010) Working paper

- Yoshida and Sugiura Presented in March 2011

- Jaffee, Stanton and Wallace (November 2010) Working paper

- Zheng, Wu, Kahn and Deng Feb 2011

- Fuerst and McAllister Energy Policy, published 2011

- Kok and Jennen Energy Policy (2012) Available online.

- Harrison and Seiler Published in Journal of Property Investment and Finance 2011

- Newell, McFarlane and Kok Report for Australian Property Institute September 2011

- Das, Tidwell and Ziobrowski (2011) Published in Journal of Sustainable Real Estate

- Fuerst, van de Wetering and Wyatt (2012)

- Reichardt, Fuerst, Rottke and Zietz (2011)

- Chegut, Eichholtz and Kok (2012) Published by RICS

- Aroul and Hansz (2012) Published in Journal of Real Estate Research

- Australian Bureau of Statistics (2007) Report for Department of Environment, Water, Heritage and the Arts

- Fuerst, Gabrieli and McAllister (2012) Non-refereed paper presented at ARES conference

- Kok and Kahn (2012) Publication produced by UCLA

- Hyland, Lyons and Lyons University of Oxford, Working Paper

Version 3:

- Eichholtz, P., Kok, N., & Quigley, J. M. (2013). The economics of green building. Review of Economics and Statistics, 95(1), 50-63. https://escholarship.org/uc/item/3k16p2rj

0 Comments