Investor acceptance and concern about climate change has shifted remarkably over the past year. Companies are now making sure that positive impacts on climate change mitigation are at the forefront of their strategies moving forward. ESG has been powerful, but is certainly under scrutiny from investors and business leaders like Elon Musk, who question its efficacy.

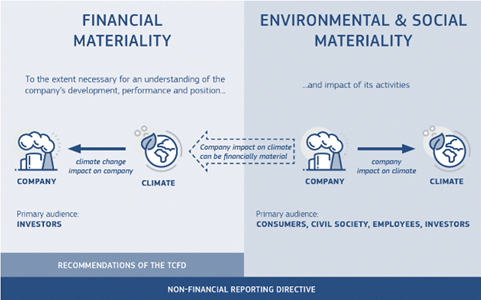

While many view ESG as a company’s impact on the environment and society, companies are viewing it as an indicator to investors on their business’ risks related to climate and more. This is a big disconnect, leading to the recent scrutiny. There is a great three-part article by Joel Makower that describes this well. What the public wants are companies to be held responsible for their impact, and what businesses want is to showcase how they’ve minimize their risks. This essentially outlines what the EU describes as Double Materiality.

ESG is mainly designed right now to score a business on their risk factors (the left side of the double materiality image below), and not designed to provide insight into how their business impacts the environment and more (the right side of the double materiality image below). This distinction has been confusing to investors. EFRAG and SEC are undergoing public consultation on enhanced ESG investment practices and new reporting standards for business’ carbon impact in the form of Scope 1 (direct emissions), Scope 2 (emissions from electricity), and Scope 3 (indirect emissions) in an attempt to address this current issue.

While investors are struggling to decide what’s most important between reducing investor risks, fighting climate change, and advocating for social impact, the buildings industry has had this figured out for a while; it’s not a decision between the three, but rather, smart strategies can and should address all three social, environmental and financial risks and impacts. And while some businesses are spending to achieve positive impacts – such as Salesforce’s 1 Trillion tree promise – buildings are a great example of where companies can invest to both reduce their impact and reduce their risks, attacking both sides of the double materiality equation at the same time.

Reducing a building’s carbon footprint not only fights climate change, but reduces future regulatory risks, and if the retrofit is done with the community in mind, can address local societal needs. A building owner may decide to retrofit to reduce their dependence on fossil fuels by installing some on-site solar to reduce their carbon footprint, which in-turn can also help power that building through an outage and reduce future regulatory penalty risks. Another building owner may decide to undergo a deep retrofit to electrify a building to avoid future taxes, while attracting new tenants with upgraded amenities.

A great example of this is the Western North York Community Centre in Toronto, Canada that was designed to achieve a net zero status, reducing energy needs and future operating costs, while addressing the local community need to bridge two suburbs together.

ESG still has the power to drive change, if it’s approached with that intent in mind. In order to unlock the potential profits and reduce the material financial risks that ESG investors are hoping businesses are able to, looking at investments from both risk reduction and impact is critical. The unprecedented growth in investor demand for ESG investments has proven that there is a desire for climate change accountability, which is likely to come soon in the form of new reporting requirements. The companies that address these issues with an understanding of not just how their bottom line is affected, but also how their business affects stakeholders will set them apart from the rest.

Are you a building owner looking to drive positive change for the future of your business and the environment? Autocase can help:

- Quantify social co-benefits from building retrofits

- Identify the best life cycle approaches to decarbonization

- Coming soon! Visualize and explore portfolio decarbonization roadmaps

WATCH OUR CEO, JOHN WILLIAMS, DISCUSS THIS TOPIC ON FINTECH