Buildings are low hanging fruit to decarbonize

We all know that just reporting on emissions is useless if it isn’t backed up by action to decarbonize.

The business case to decarbonize from a macro perspective is clear-cut. Without factoring the moral imperative, climate change has intensified natural hazards such as coastal and inland flooding, forest fires, sea level rise, drought, and storm events, leading to large economic losses.

Given that buildings contribute roughly 37% of global CO2 emissions (with the sector’s operational energy-related CO2 emissions reaching ten gigatonnes of CO2e in 2021) the existing building stock is low hanging fruit to make a meaningful dent in the fight to decarbonize.

However, the business case to convince individual building owners to decarbonize has been harder to make. There is no direct relationship at the micro level between cause (i.e. reducing emissions) to effect (i.e benefiting from lower climate-induced damages) – thus a lack of direct incentive to act in many regions.

While there may be some no-brainer building decarbonization strategies out there that both save carbon and have a great pay-back, let’s be honest, the process to decarbonize a portfolio is not always going to be cheap.

But perhaps maybe we’re framing the argument in the wrong way. Instead of saying what might be gained from some individual strategies, we should more clearly articulate what may be lost from doing nothing.

Why you should decarbonize your buildings?

Climate change and the transition to a net zero carbon future is transforming the face of real estate, with those being left behind vulnerable to the ‘brown discount’. Essentially, building owners need to decarbonize because if they don’t, they risk being left with less desirable or even stranded assets, but – ultimately – less valuable assets.

This is due to five key risk factors:

- Regulatory risk;

- Financing risk;

- Operational cost risk;

- Reputational risk; and

- Resilience & business continuity risk

Let’s explore each of these in order below.

New building code regulations

One of the greatest reasons to decarbonize your existing building portfolio is that you’ll likely have to do it soon anyway due to changing regulations.

For example, Local Law 97 in New York City requires most buildings over 25,000 square feet to meet new energy efficiency and greenhouse gas emissions limits by 2024, with stricter limits coming into effect in 2030. There are also many other local building performance standards that are in place (or under consideration) that set energy or emission targets for existing buildings. A similar example in an adjacent market is electric cars, with multiple regions now setting specific dates on which gas powered cars will no longer be allowed to be sold.

It’s best that you have a cost-effective decarbonization plan in place before having to scramble one together once it’s too late.

Lower access to financing

Another risk of not decarbonizing your existing buildings is the potential for lower access to investment and less preferential financing terms. As ESG reporting requirements become more and more climate-focused, public companies that cannot showcase an actionable path to decarbonization may find it harder to secure investment and financing.

Furthermore, as more and more of the market takes action on reducing the CO2 footprint of their assets, those buildings that are left behind will become less attractive to tenants and buyers – resulting in a ‘brown discount’ and making it harder to recover investment costs.

Increasing operational costs

The more that operational utility costs are tied to GHG emissions, the stronger the case to decarbonize your building portfolio. Building owners want to keep their net operating income (NOI) as high as possible. Implementing decarbonization strategies like energy efficiency and eliminating fossil fuels is one way to help achieve this.

- Firstly, as we’ve seen in Europe, natural gas prices are prone to sharp increases. Buildings that are not energy-efficient and rely on fossil fuels for heating and cooling are likely to face higher energy costs over time. As energy prices rise, NOI declines and these buildings may become less desirable, leading to lower occupancy rates.

- Secondly, climate change is causing temperatures to rise – leading to more cooling degree days (and thus more energy usage of HVAC systems), which is increasing utility bills.

- Lastly, regulated carbon prices such as Canada’s, as well as cap and trade systems like in California – that effectively generate market prices for each tonne of CO2 – increases the cost of doing business for those who emit.

Reputational risk

Building owners who do not decarbonize their portfolio face reputational damage. In today’s consumer climate-savvy world, consumers and investors are increasingly concerned about the environmental impact of their choices and willing to vote with their wallets. Businesses that do not show meaningful action towards decarbonization may be perceived negatively by stakeholders, leading to reputational damage that can affect long-term viability.

Climate resilience & business continuity

Finally, building owners who do not decarbonize their portfolio also face physical risks associated with climate change. Extreme weather events such as floods, storms, and wildfires are becoming more frequent and severe due to climate change. Climate change leaves those relying on aging infrastructure vulnerable to shocks – often resulting in costly repairs, down-time, or even abandonment. Building owners should retrofit their assets that both decarbonize and improve the resilience to external shocks.

Tools to help you decarbonize

Annual GHG reporting is a great start, but it’s the actions put into place based on that data that helps businesses thrive in an uncertain climate future.

It’s time to evolve from just reporting on GHG emissions to reducing emissions through an actionable and cost-effective decarbonization plan.

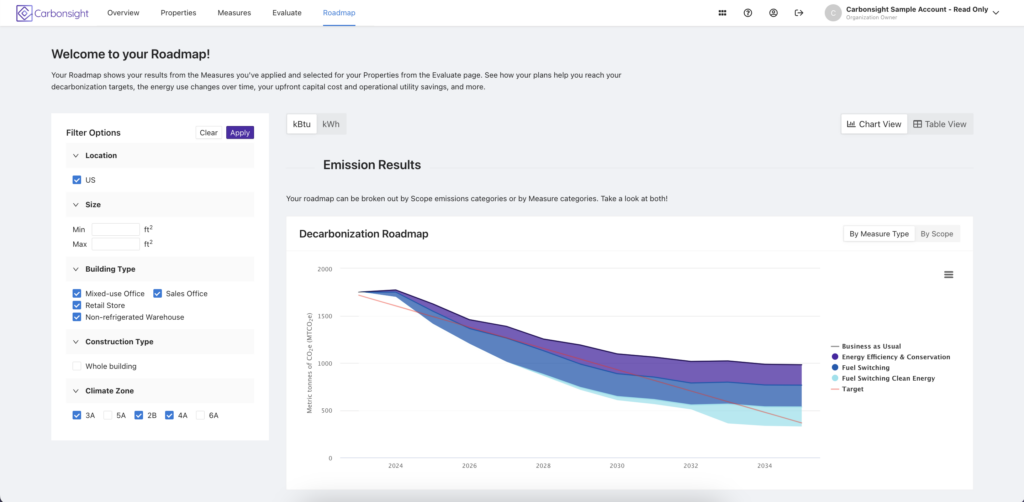

The business case to reduce emissions is clear from a risk-mitigation perspective, but coming up with an actionable decarbonization plan can take a long time, be expensive, and is hard to get right. That’s why it’s more important than ever to use the best tools available to support that journey and make it quicker, cheaper, and less hassle to build actionable decarbonization plans.

See how you can cost effectively decarbonize your real estate portolfio with Carbonsight by Autocase

0 Comments