Margaret Wente (Trudeau’s climate ‘deal’: all pain, no gain – Globe and Mail Dec. 13) says of the planned carbon tax and cap-and-trade schemes that “No cost-benefit analysis has been provided, or ever will be …”. Perhaps because it is such a no-brainer.

Using data from Environment Canada on the social cost of carbon, Canada’s predicted emissions, and our emissions targets, the benefit of reaching these targets gets into the billions in just a couple of years. Further, money collected from taxes does not disappear as Ms. Wente suggests. But let’s assume it does (although hopefully not by burning the money which may add emissions) and also that cap-and-trade makes the rest “disappear by stealth” as she suggests will happen, so that all of the carbon compliance is a cost/loss to society. Even in this extreme case, there is still a large net benefit to society because the proposed tax per tonne is less than the benefit we get from reducing our emissions.

Here’s how I come to the conclusion that a carbon tax of $10 a tonne in 2018 and rising $10/year to $50 in 2022 is a good deal.

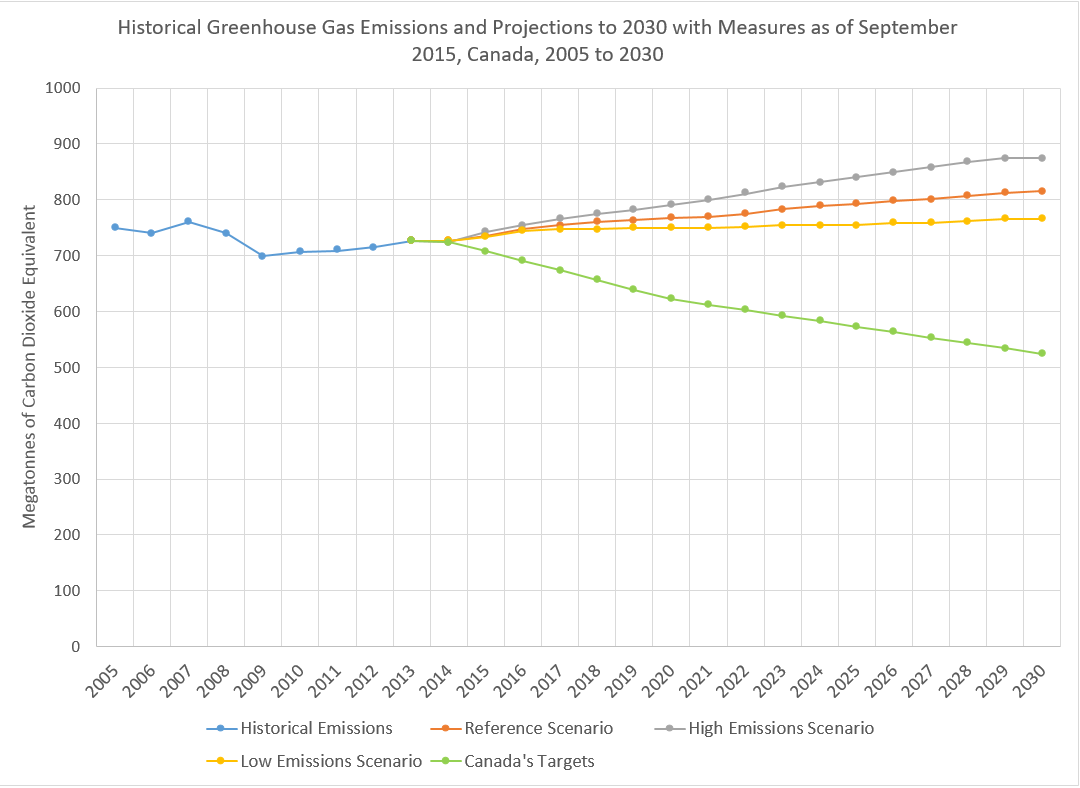

First, Environment Canada shows Canada’s targets and three scenarios for carbon emissions:

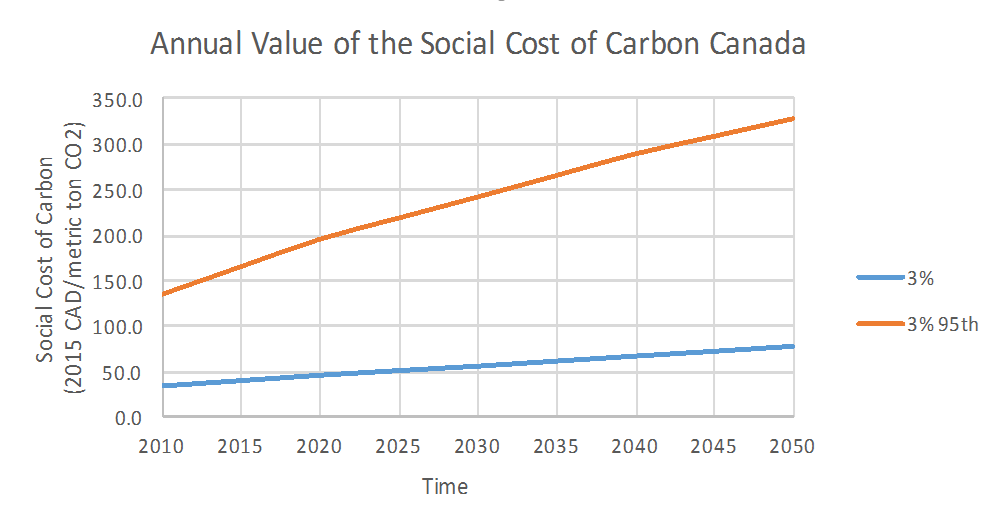

Second, the benefits of meeting these targets is the Social Cost of Greenhouse Gas (CO2), again from Environment Canada:

“The Government of Canada requires departments and agencies to conduct cost-benefit analysis of regulatory proposals … that would affect greenhouse gas (GHG) emissions.”

The appropriate monetary benefit value for reducing GHG emissions is in terms of the altered impacts of climate change. “The SCC is a measure of the incremental additional damages that are expected from a small increase in CO2 emissions … Estimates of the SCC therefore provide a way to value CO2 emission changes in cost-benefit analysis …”.

I have used the lower, more conservative value (denoted 3% in the chart which is the discount rate used in the climate models that generated these values):

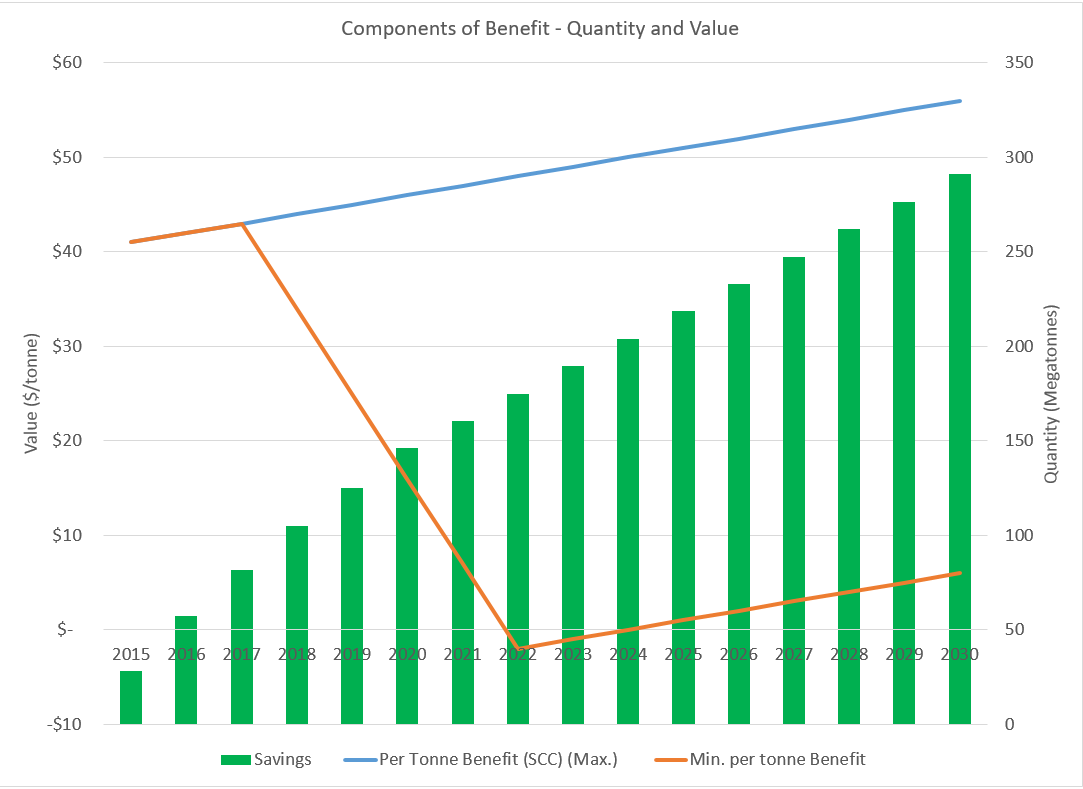

Third, to do the cost-benefit analysis all you need to do is multiply the carbon emissions reductions (Savings in the chart below) by the value or social cost of carbon. The best case is that the carbon tax has no economic cost. The worst case is that the money collected from the tax is destroyed rather than spent (as it is now in Alberta) or re-distributed (as it is in B.C.). The maximum value is the social cost of carbon. The minimum value is the social cost of carbon minus the federal carbon tax (which is a floor on the provincial systems). So, here are the components of the benefit with the minimum and maximum value:

You can see that only in 2022, when the currently proposed tax/price caps at $50/tonne is the amount above the social cost of carbon.

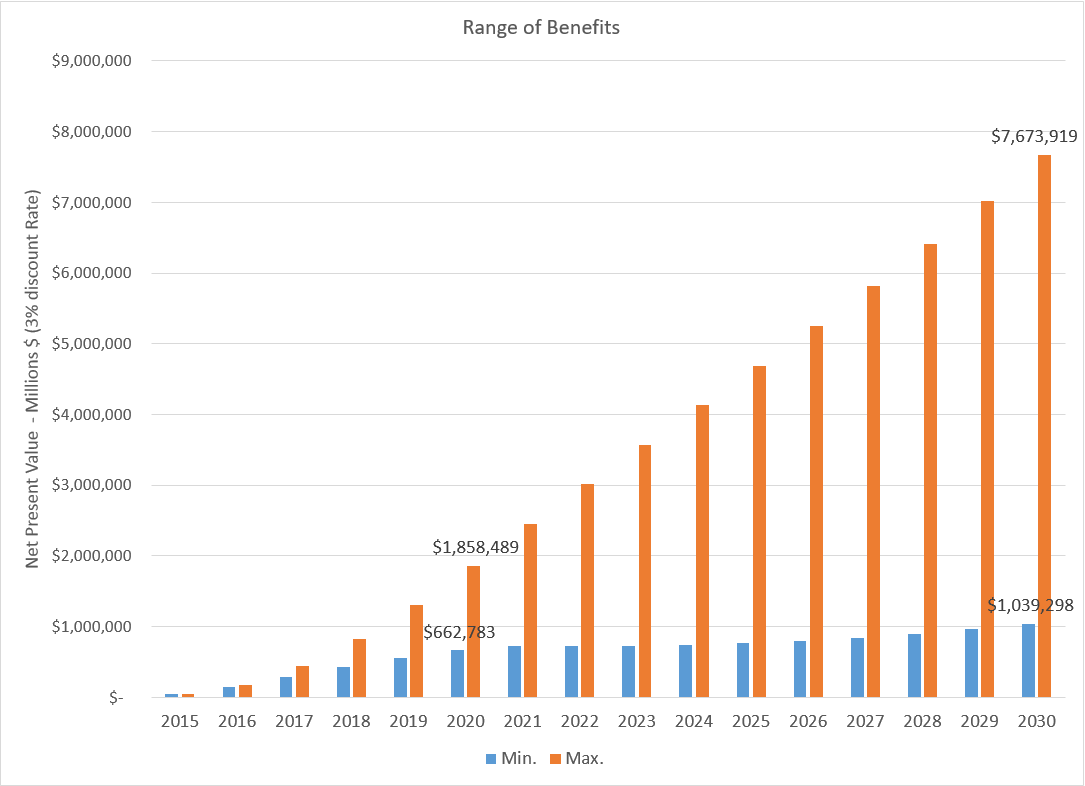

The discounted (net present value) of the benefits of grows over time. In 2020 the net benefit to society is between $662 million and $1.8 billion. This grows to between $1 billion and $7.6 billion in 2030.

So there you go – a cost-benefit justification for Canada’s Climate Plane. You are welcome.

0 Comments